Asseturi Unveiled: Navigating the World of Assets

“Asseturi” – the very word conjures images of abundance, stability, and potential. But what exactly are they?

In its simplest form, an asset is anything with economic value – something that can be owned and used to generate income or benefit its owner in some way.

However, the world of assets is vast and varied, encompassing a dizzying array of categories. This article aims to shed light on the different types of assets, their roles in our lives, and how they can be leveraged for wealth creation and growth.

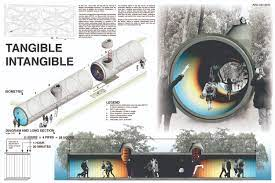

Broadening the Horizon: From Tangible to Intangible

Traditionally, the term “asset” was largely associated with tangible possessions like land, buildings, equipment, and even precious metals.

These physical assets are still fundamental pillars of individual and economic prosperity. Owning a home, for example, offers not just shelter but also equity and potential capital appreciation. Businesses rely on machinery, vehicles, and other tangible assets to operate and generate revenue.

But in today’s knowledge-driven economy, the realm of assets extends far beyond the physical. Intangible assets, such as intellectual property (patents, copyrights, trademarks), brand recognition, and skilled human capital, have become increasingly valuable.

A powerful brand, for instance, can command premium prices and attract loyal customers, propelling a company’s success. Similarly, an individual’s skills and expertise can be leveraged to generate income and career advancement.

Financial Assets: Fueling the Engine of Growth:

Financial assets, encompassing stocks, bonds, cash, and derivatives, form another critical category. These assets represent ownership or claims on other assets, generating returns through dividends, interest, or capital appreciation.

Investing in a diversified portfolio of financial assets allows individuals and institutions to grow their wealth over time, weather economic storms, and secure their future.

Also Read: SPOTLIGHT ON SUCCESS: MARIAH BIRD’S ACHIEVEMENTS

The Asset Management Imperative:

Effective management is crucial for maximizing the value of any asset. This involves proper accounting, maintenance, and strategic utilization.

Businesses implement asset management strategies to ensure optimal use of their resources, maximize efficiency, and minimize waste.

Individuals, too, can benefit from proactive asset management, utilizing budgeting tools, financial planning, and investment strategies to optimize their financial resources.

The Road to a Secure Future: Building Your Asset Base:

Understanding and cultivating different types of assets is key to building a secure and prosperous future. Here are some steps you can take:

- Invest in yourself: Develop your skills and knowledge through education and training.

- Diversify your income streams: Don’t rely solely on salary; explore freelance work, investments, or side hustles.

- Plan for the future: Save and invest wisely for retirement and other long-term goals.

- Seek professional guidance: Consult a financial advisor or asset manager for personalized recommendations.

Also Read: ANDREA SKEETE: A VISIONARY LEADER’S JOURNEY

Concluding Thoughts: A Tapestry of Opportunities

Asseturi are not just possessions; they are the building blocks of wealth, security, and growth. By understanding their diverse nature, actively managing them, and strategically expanding your asset base, you can pave the way for a brighter and more fulfilling future.

Remember, the world of assets is not a passive landscape – it is a dynamic tapestry of opportunities waiting to be explored and harnessed.

FAQ’s:

Q1. What’s the difference between tangible and intangible assets?

Tangible: You can touch it, like land or equipment. Intangible: It’s non-physical, like brand value or expertise.

Q2. Why invest in financial assets?

They can grow your wealth over time through dividends, interest, or price appreciation.

Q3. How can I manage my assets effectively?

Track expenses, budget, invest wisely, and consider seeking professional guidance.

Q4. Are cryptocurrencies considered assets?

It depends on regulations and individual perspectives. They can have economic value but lack some traditional asset features.

Q5. Do natural resources like water count as assets?

Yes, their scarcity and economic importance make them valuable assets.

Q6. Can skills and knowledge be assets?

Absolutely! They can generate income and improve employability, making them valuable assets.

Q7. Is time an asset?

Time is a precious resource, but its categorization as an asset is subject to interpretation and context.

Q8. If I have a big debt, does it mean I have negative assets?

Debt is actually a liability, which reduces your net asset value.

You May Also Like

Freezing Green Beans: A Guide to Preserving Freshness

March 8, 2024

I’m the Queen in This Life spoilers – Read Online In 2024

December 1, 2023

Average Rating